It’s a question that many people are asking: how the Covid-19 mortgage crisis is affecting British consumers. As the housing market enters a period of significant decline, the government has given homeowners some comfort in the form of a one off scheme which offers low interest rates and repayment holidays for those who have applied for a mortgage and found themselves unable to continue making their repayments.

Although the scheme hasn’t been introduced as a solution to the problem of rising prices, it has proved to be a great boost to the mortgage industry. In the last month alone, there has been a significant increase in applications. There’s no telling whether this increase is temporary or permanent, but it does point to the benefits of the scheme.

The latest Covid-19 research on mortgage stress and financial difficulties has shown that those with problems getting the monthly repayments can be hit by more than just the usual “burden” of monthly instalments. The new research is also likely to have an impact on the next wave of consumers who are starting to get into serious financial difficulty. This article will explain how mortgage stress can be effectively addressed through changes to UK law and by using a number of practical and effective strategies.

It seems that mortgage borrowers who are at risk of foreclosure and who cannot make their monthly instalments are often hit by two separate stresses. Firstly, their debts are too high and their income is not enough to support the repayments on their homes. Secondly, it is common for those in this position to fall behind with their repayments as they struggle to make ends meet, making their situation even more difficult. The combination of these two stresses means that many people are falling behind with the repayments on their homes and having to start defaulting on their mortgages.

Despite the current housing market conditions, many people have been unable to afford the mortgages that they are currently paying. As such, there is a growing number of families that are finding that they have found themselves unable to meet their repayments and have found themselves in serious financial trouble.

The Covid-19 research has found that those in danger of becoming behind with their mortgage repayments are generally likely to have experienced a period of “credit pressure” before. People who have found themselves struggling with bills and with credit are more likely to experience further financial difficulties as their debts increase and they become further behind on their mortgage repayments.

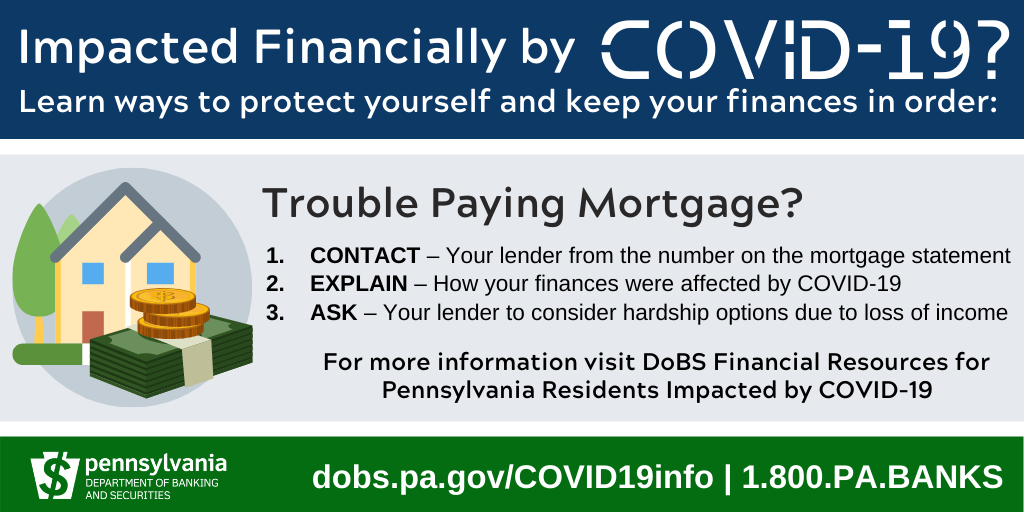

If you have found yourself struggling with your finances, you may well have found yourself asking yourself whether or not you can afford the repayments on your mortgage. If so, then you may have also asked yourself whether you have any other options available to you that would allow you to continue to make your repayments on time. If so, then you should keep reading to learn more about how you can find a solution that is not only affordable but also effective and contact Blutin Finance.

One of the most common ways that many people have been able to pay off their mortgages and prevent the problem of mortgage stress from coming back again is by taking out a loan to pay off their existing debts. This loan could be a debt consolidation loan or a debt management loan.

A debt consolidation loan is a loan that is taken out against an existing loan and replaces the current one with a single loan to pay off all of the debt that you have. There are different types of debt consolidation loans, including secured debt consolidation loans and an unsecured debt consolidation loan. Both of these types of loan can be very effective at helping people to stop the amount of money that they are paying towards each debt coming off and reducing the amount of interest that they are paying.

By taking out one loan, you can reduce the amount of interest that you are paying on the other debts, thereby lowering the monthly instalments that you need to pay. You can then use the money you have saved and use it to pay off the other debts.

On the other hand, the unsecured debt consolidation loan does not require you to put up any property as collateral, so if you cannot pay off the loan then there is no risk to the lender. It is simply a loan that you can borrow against, and that can help you reduce the amount of interest that you are paying as well as the amount of money that you are currently paying towards your repayments on your debt.

Conclusion

Are Mortgages Being Affected by Covid-19? Yes, But you don’t need to worry; there’s no need to panic. The authorities are looking very hard to fix the problems with this scheme, but don’t panic if you have a problem with your mortgage.

All you have to do is sit down and talk to a specialist about the situation and try to come to an agreement. You may also be able to take advantage of the free advice that is available.

Be the first to write a comment.